ERP & E-Invoice Accounting Malaysia

Get LHDN's Compliant with Goldsoft ERP E-Invoice Solution

GET STARTED

Thank you for contacting us.

We will get back to you as soon as possible.

Please try again later.

Why choose Goldsoft ERP for Malaysia E-Invoicing?

With 27 years of experience in developing ERP and accounting solutions for local retail and trading distribution businesses, Goldsoft brings unparalleled expertise to the forefront. Having successfully navigated compliance changes such as Goods and Services Tax (GST) and Sales and Services Tax (SST), Goldsoft is well-equipped to guide businesses through the e-invoicing journey.

Be Ready & Compliant

Prepare for seamless compliance with LHDN e-invoicing transmission, validation standards, and regulations.

Local ERP Expertise

Your trusted IT solution partner, evolving with your business needs, including government compliance requirements.

Local Customer Support

Dedicated account manager and customer support teams for prompt issue resolution.

e-Invoicing Implementation Timeline in Malaysia

| Phase | Targeted Businesses Annual Turnover | Implementation Date |

|---|---|---|

| 1 | > RM 100 million | 1 August 2024 |

| 2 | > RM 25 million and up to RM 100 million | 1 January 2025 |

| 3 | All taxpayers | 1 July 2025 |

Implementation is based on annual turnover starting with businesses having annual revenue of RM100 million or more.

| # | Scenario | Annual Turnover/ Revenue Based On |

|---|---|---|

| 1 | Businesses with audited financial statements | Based on annual turnover or revenue in the audited financial statements for financial year 2022. |

| 2 | Businesses without financial statements | Based on annual revenue reported in the tax return for year of assessment 2022. |

| 3 | Businesses with change of financial year 2022 | Taxpayer’s turnover or revenue will be pro-rated to a 12-month period for purposes of determining the e-Invoice implementation date. |

What are the benefits of adopting e-invoicing?

Streamline Financial Processes

Provides businesses of all sizes and sectors in Malaysia with an opportunity to streamline their financial processes, reduce manual works and improve transparency.

Improve Cashflow

Accelerate payments by significantly reducing billing and calculation errors with e-invoicing, thereby minimizing disputes and irregularities.

Compliance and Accuracy

The implementation of a compliant interoperable E-Invoicing framework will help you stay compliant with government regulations and industry standards.

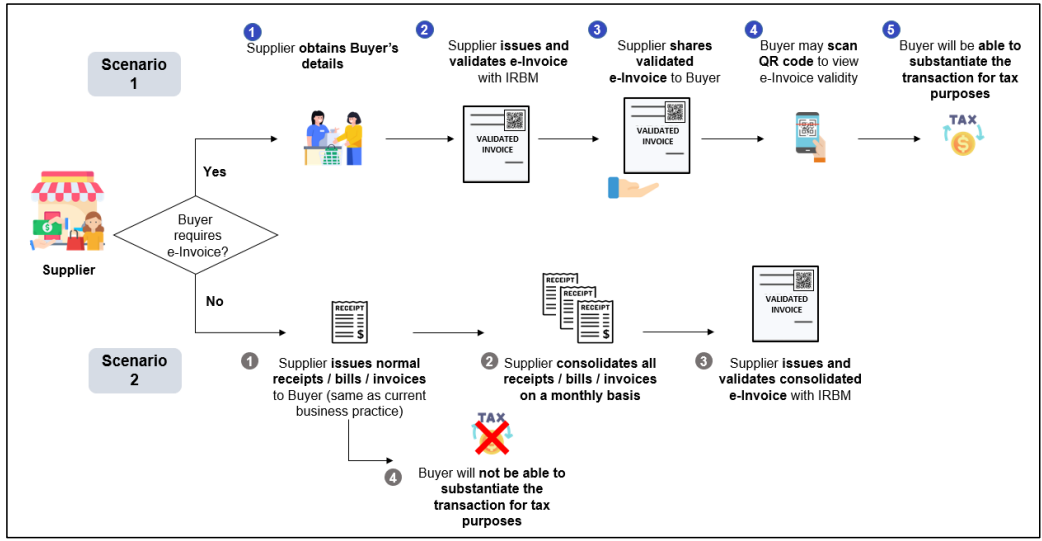

Malaysia E-Invoice Process Flow

The E-Invoice Process Flow:

- When a supplier issues an invoice, credit note, or debit note, it must first be submitted to LHDN for validation via their portal.

- Once the invoice has been validated, LHDN will provide a Unique Identifier Number for the document.

- The supplier then needs to embed this Unique Identifier Number, in the form of a QR code on the invoice before forwarding it to their customer.

- Note that at this point, the status of the invoice will be pending.

- The customer then has the option to either accept or reject the invoice within 72 hours.

- If the customer does not accept the invoice, then the status will be changed to approved.

- If the customer rejects the invoice, they need to provide a reason, and the seller will be notified, and can re-submit an amended invoice.

- If the invoice is rejected after approval, then the seller will need to issue a credit note to cancel it.

- The credit note will need to go through the same process as the invoice, submit to LHDN for validation, get a Unique Identifier Number, and forward to the customer.

- With the implementation of e-invoicing, buyers will only be able to claim an expense if it is supported with an invoice that has been validated through the portal and has a valid QR code.

*Important Note* 72-Hours Grace Period

Seller and buyer can reject or request cancellation of an e-invoice within 72 hours. After this period, modifications to e-invoices are not allowed. If any changes are required after 72 hours, businesses must issue a new invoice, debit note, credit note, or refund.

Goldsoft E-Invoicing ERP Key Features and Benefits

Complete E-Invoice Process

Comprehensive e-invoicing management from generating compliant invoices to secure submission to the LHDN Malaysia.

E-Invoice Features

Automatic invoice generation, data validation, secure storage and transmission, QR code generation, and real-time tracking of invoice statuses.

Error Prevention

Employing Smart Validation Checks Tailored Specifically for E-Invoices to Ensure Accuracy.

Training & Support

Provide staff training on using the system, along with ongoing support and technical assistance to ensure smooth operations.

Data Security

Protect your valuable financial information through industry standard encryption, secure cloud infrastructure, and stringent access controls.

Future Enhancements

System keep up with future enhancement with evolving IRBM requirements.

How to Prepare for e-Invoice Implementation?

1. Know your implementation deadline

Understanding the timeline for implementation allows companies to plan and allocate resources effectively to meet the deadline without facing penalties or disruptions to their operations. Refer implementation date

here.

Goldsoft ERP E-Invoice Solution

Suitable for Retailers and Distributors

- Generate, send and receive e-invoices within the Goldsoft ERP system.

- Real-time monitoring and tracking of e-invoice submissions, validations, and statuses.

- Goldsoft is pursuing

Peppol Service Provider (SP) and Peppol-Ready Solution Provider (PRSP)

accreditation under Malaysia's e-Invoicing framework with MDEC for B2B digitalization.

- Goldsoft is a member of Peppol (Pan-European Public Procurement Online, is an international network that facilitates electronic procurement processes between businesses.)

Get In Touch With Us

We'll explore your system requirements and discuss the specifics needed for you to achieve e-invoice compliance.

GET STARTED

Thank you for your inquiry.

We will get back to you as soon as possible.

Please try again later.

E-Invoice FAQ- General Questions

-

What is e-Invoice?

e-invoice signifies the digital process of documenting each transaction electronically. With the comprehensive adoption of electronic invoicing, physical receipts will become unnecessary, and all transaction records will be securely stored in the LHDN database.

-

What are the types of e-invoice?

1. Invoice: A commercial document that itemises and records a transaction between a Supplier and Buyer, including issuance of self-billed e-Invoice to document an expense.

2. Credit Note: A credit note is issued by Suppliers to correct errors, apply discounts, or account for returns in a previously issued e-invoice with the purpose of reduced the value of the original e-invoice. This is used in situations where the reduction of the original e-invoice does not involve returning of monies to the Buyer;

3. Debit Note: A debit note is issued to indicate additional charges on a previously issued e-Invoice;

4. Refund Note: A refund e-invoice is a document issued by a Supplier to confirm the refund of the Buyer’s payment. This is used in situations where there is a return of money to the buyer.

-

Is e-invoice applicable only to domestic transactions in Malaysia?

No. The issuance of e-Invoice is not limited to only transactions within Malaysia. It is also applicable for cross-border transactions.

-

Who is involved?

According to the e-Invoicing guidelines set forth by LHDN (Lembaga Hasil Dalam Negeri), Malaysia, these three transaction types are currently considered primary within the invoicing scope.

B2B (Business-to-Business) Transactions: B2B transactions involve the exchange of goods or services between two businesses. These transactions occur between manufacturers, wholesalers, retailers, or service providers.

B2C (Business-to-Consumer) Transactions:B2C transactions involve the sale of goods or services from a business directly to consumers. These transactions are commonly seen in retail environments, online shopping platforms, and service industries.

B2G (Business-to-Government) Transactions: B2G transactions involve business entities providing goods or services to governmental organizations or agencies.

-

Is a PDF invoice considered an e-invoice?

No. An e-invoice pertains to an invoice that is created, issued, and capable of generating documents that the LHDN system can automatically interpret in an electronic format.

Documents meeting these criteria include XML and JSON formats.

Documents that do not meet these criteria include PDF, DOC, JPG, etc.

-

What is TIN number?

A TIN number is a person’s tax number, refer to the link for details: https://www.goldsoft.com.my/e-invoice-malaysia-what-is-tin-number

E-Invoice FAQ- Seller and Buyer Questions

-

What is the transmission mechanism to transmit e-Invoices?

IRBM has provided two (2) e-Invoice transmission mechanisms:

1. Through the MyInvois Portal provided by IRBM; and

2. Application Programming Interface (API).

-

The difference between MyInvois portal and API integration?

MyInvois Portal:

- Billing Method: Allows sellers to generate e-invoice directly and allows sellers to batch generate through spreadsheet upload for processing multiple transactions.

- Invoice Sharing: Available in PDF, XML, JSON, CSV format in both sellers & buyers’ tax account.

- Key Feature: e-Invoice easily keep as it availables in both sellers & buyers tax account.

- Ideal Users: Sellers who have small amount of transactions e.g. Micro & SME.

API Integration:

- Billing Method: Sellers need to upload invoices via API connection after the invoices are ready (generated through seller’s own ERP system)

- Invoice Sharing: Through QR code on the e-invoices.

- Key Feature: Sellers can generate invoices using their current ERP/accounting system and then upload them through the API interface for LHDN to review and certify in a single step.

- Ideal Users: Sellers who have large transaction volume and have own accounting ERP/accounting system.

-

As a small business owner, is it necessary to issue e-invoices?

All sellers must implement e-invoicing, but LHDN allows sellers to issue standard bills/receipts/invoices based on sellers' current practices to those buyers not requesting e-invoices for tax deduction purposes. Subsequently, sellers are required to consolidate all standard invoices and issue a consolidated e-invoice at the end of each month.

-

What type of activity/transaction where consolidated e-invoice is not allowed?

- Automotive

- Aviation

- Luxury goods and jewellery

- Construction

- Wholesalers and retailers of construction materials

- Licensed betting and gaming

- Payment to agents /dealers/distributors

-

If the buyer forgets their TIN number, can they provide their IC number instead?

Yes. For taxpayers, an e-invoice requires either a TIN or an IC number, but for non-taxpayers, the TIN number is mandatory.

-

Can e-Invoices be amended after submitting to LHDN?

No, the supplier would need to cancel the e-invoice within 72 hours from the time of validation and reissue a new e-invoice. The cancellation request should specify the reason.

Any changes after 72 hours from time of validation would require the supplier to issue a new e-Invoice (i.e., debit note, credit note, refund note e-Invoice) to adjust the original e-Invoice issued.

-

Can e-Invoices be cancelled after submitting to LHDN?

Yes, e-Invoices can be canceled within 72 hours of issuance. To cancel an e-invoice. the supplier/customer must submit a cancellation/rejection request to buyer/seller within 72 hours via the MyInvois Portal.

Any changes after 72 hours from time of validation would require the supplier to issue a new e-Invoice (i.e., debit note, credit note, refund note e-Invoice) to adjust the original e-Invoice issued.

-

What if the seller/buyer doesn’t approve my request for amendment/cancellation?

Once the 72-hour window has passed, the e-invoice status will automatically transition to "Valid," and any subsequent modifications will necessitate the issuance of a Debit or Credit Note.

-

How are e-invoices validated and stored?

After an e-Invoice is generated, it is sent to IRBM. IRBM then verifies mandatory fields and other crucial details, informing both supplier and buyer accordingly. Additionally, they can access a summary of generated e-Invoices via the My Invois Portal.

-

What are the consequences for failure to issue e-Invoice?

Failure to issue e-Invoice is an offence under Section 120(1)(d) of the Income Tax Act 1967,

and will result in a fine of not less than RM200 and not more than RM20,000 or imprisonment not exceeding 6 months or both, for each non-compliance.

E-Invoice Blog You May Also Like

HEADQUARTERS

Goldsoft Sdn. Bhd.

199701012508 (428004-P)

VO5-07-07 & 08, Signature Office,

Lingkaran SV, Sunway Velocity,

55100 Kuala Lumpur, Malaysia.

General Line: 03-2732 8833

Sales Line: 016-6611 086

Email: marketing@goldsoft.com.my

@ Copyright 2009-2023 Goldsoft Sdn. Bhd. I Company Registration 199701012508 (428004-P). All Rights Reserved.

Retail Inventory ERP System / Trading Distribution ERP System / Retail POS System / Consignment Inventory System / Warehouse System / e-Commerce

Image by Freepik