What is EPF Account 3?

Understanding EPF's New Account Fleksibel and its Benefits for Members Under 55

What is EPF Account 3?

EPF Account 3, also known as Account Fleksibel, is a newly introduced account for EPF members in Malaysia as part of the restructuring of members’ accounts by the Employees Provident Fund (EPF), effective May 11, 2024. This account is specifically designed for EPF members under the age of 55, offering the flexibility to withdraw funds at any time and for any purpose. The introduction of EPF Account 3 aims to enhance income security after retirement while catering to the diverse life cycle needs of EPF members.

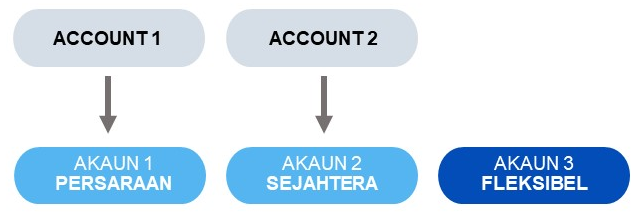

What are the New Account?

Starting May 11, 2024, all EPF members under the age of 55 will have their accounts restructured from two (2) accounts, namely Account 1 and Account 2, to three (3) accounts:

1. Account Persaraan

2. Account Sejahtera

3. Account Fleksibel

1. Account Persaraan (Originally Account 1)

Akuan Persaraan aims to accumulate and increase members’ savings for the long term to ensure a comfortable life after retirement. Savings in Akaun Persaraan cannot be withdrawn before the member reaches 55 years old.

2. Account Sejahtera (Originally Account 2)

Akuan Sejahtera aims to meet pre-retirement life cycle needs for the medium term, contributing to retirement well-being. Savings in Akaun Sejahtera can be withdrawn for pre-retirement purposes (subject to EPF terms and conditions) such as housing, education, health, insurance protection, haj withdrawl, and upon reaching 50 years old.

3. Account Fleksibel (A Newly Introduced Account 3)

Savings in Akaun Fleksibel can be withdrawn by members at any time, subject to terms and conditions. Akaun Fleksibel will start with a zero balance.

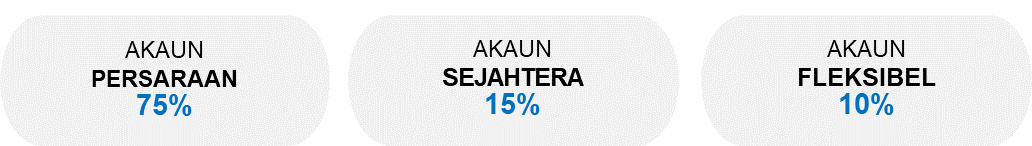

How will New Contributions be Distributed?

Contributions after May 11, 2024, will be allocated into the new accounts in the following manner:

- 75% into Account Persaraan

- 15% into Account Sejahtera

- 10% into Account Fleksibel

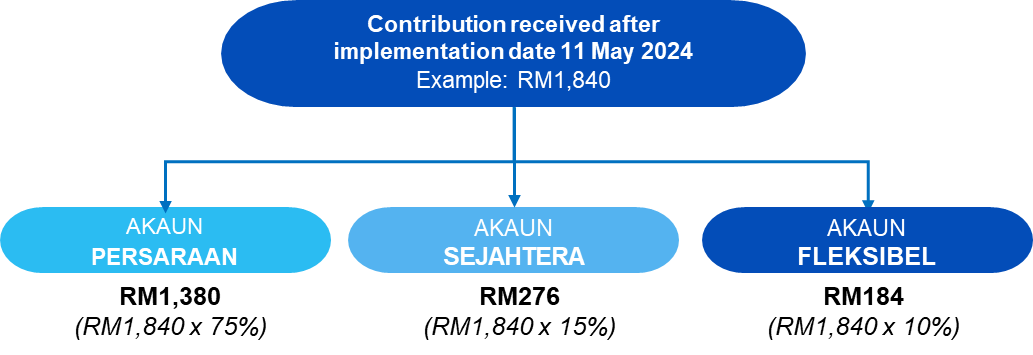

The new distribution of contributions example is as follows:

For example, if an ERP contribution of RM1,840 is received after the implementation date of May 11, 2024:

- Account Persaraan (originally Account 1) will receive RM1,380 (75% of RM1,840).

- Account Sejahtera (originally Account 2) will receive RM276 (15% of RM1,840).

- Account Fleksibel (Account 3) will receive RM184 (10% of RM1,840).

Can I Transfer Part of my Savings Initially?

Yes. Between May 11 and August 31, 2024, members will have a one-time option to transfer part of their savings from Account Sejahtera (originally Account 2) to Account Fleksibel as an initial balance.

How is the Account Sejahtera Transfer Amount Calculated?

The transfer amount depends on the member's Sejahtera balance and falls into three scenarios:

- Account Sejahtera with savings of RM3,000 and above;

- Account Sejahtera with savings of RM1,001 to RM3,000;

- Account Sejahtera with savings of RM1,000 and below.

Account Sejahtera with Savings of RM3,000 and Above:

- Five out of thirty (5/30) of the Account Sejahtera savings (RM5,000) will be transferred to Akaun Persaraan. (5/30 of RM30,000= RM5,000)

- Ten out of thirty (10/30) of the Account Sejahtera savings (RM10,000) will be transferred to Akaun Fleksibel. (10/30 of RM30,000= RM10,000)

- The remaining balance of fifteen out of thirty (15/30) will remain in Akaun Sejahtera (RM15,000). (15/30 of RM30,000= RM15,000)

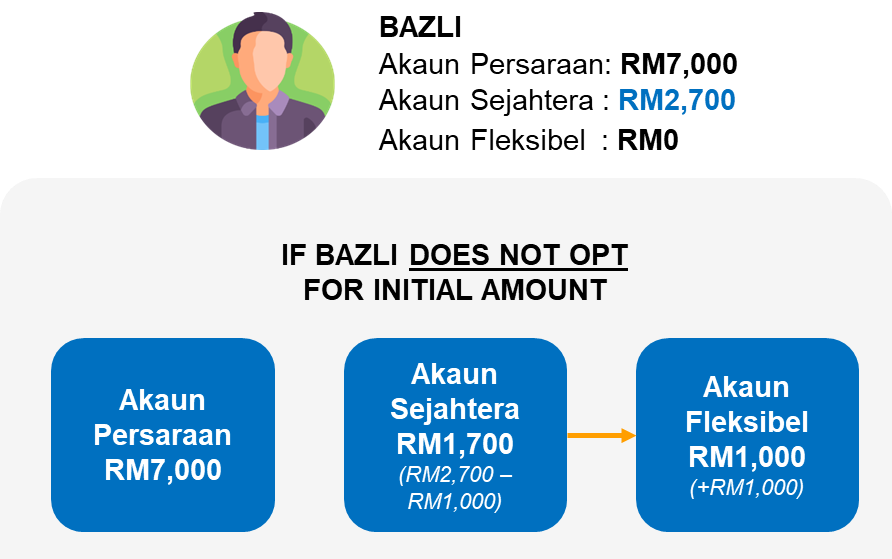

Account Sejahtera with Savings of RM1,001 to RM3,000:

RM1,000 will be transferred to Account Fleksibel, and the remaining balance will stay in Account Sejahtera.

No distribution will be made to Account Persaraan for those with savings in Account Sejahtera less than RM3,000.

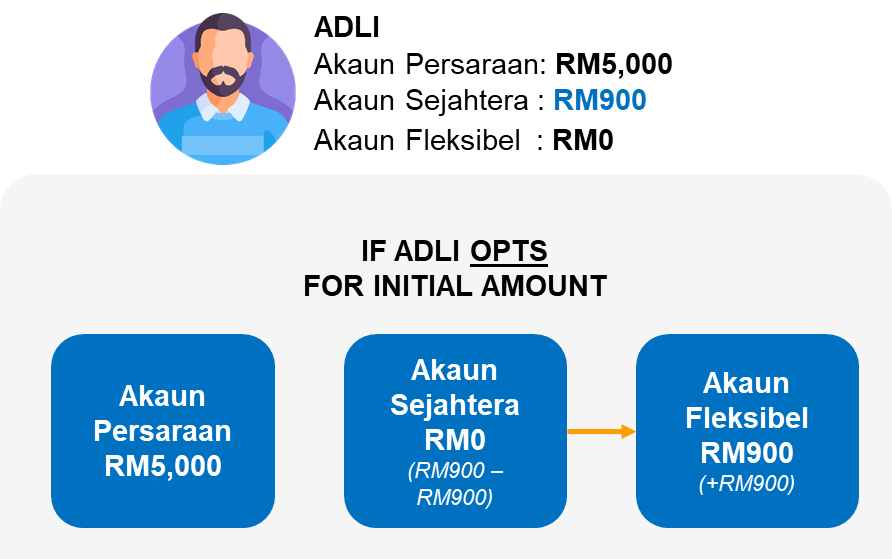

Account Sejahtera with savings of RM1,000 and below:

The entire amount in the Account Sejahtera will be transferred to Account Fleksibel.

How to Apply for Initial Transfer?

Members can apply for the initial amount transfer through the following channels:

· KWSP i-Akaun

· Self-Service Terminal (SST) at any EPF office

What Happens if I Don't Opt-In?

If a member chooses not to transfer an initial amount to Account Fleksibel, the balance in the existing account will remain in Account Persaraan and Account Sejahtera. Meanwhile, new contributions starting May 11, 2024, will be credited into Account Persaraan, Account Sejahtera, and Account Fleksibel.

How Can I Withdraw from Account Fleksibel?

Withdrawals from Account Fleksibel can be made at any time for any purpose, subject to a minimum withdrawal amount of RM50. Members who have not yet registered with KWSP i-Akaun are encouraged to do so to facilitate withdrawal transactions from Account Fleksibel.

What Will Happen to My Account After I Turn 55?

Upon reaching age 55, your savings in Account 1 and Account 2 will be combined and put into this account 55. When members turn 55, they can make withdrawals and have access to savings in Account 55 anytime. They can perform a lump sum withdrawal, monthly withdrawals or partial withdrawal. Any new contributions made after age 55 will be credited to Account Emas.

For more information about EPF on Goldsoft Payroll, email to us at marketing@goldsoft.com.my

Information source: www.kwsp.gov.my

#EPF #AkaunFleksibel #AccountFlexible #EPFAccount3 #Account3 #EPFMalaysia

Get In Touch:

Thank you for your inquiry.

We will get back to you as soon as possible.

Please try again later.

Related Articles

HEADQUARTERS

Goldsoft Sdn. Bhd.

199701012508 (428004-P)

VO5-07-07 & 08, Signature Office,

Lingkaran SV, Sunway Velocity,

55100 Kuala Lumpur, Malaysia.

General Line: 03-2732 8833

Sales Line: 016-6611 086

Email: marketing@goldsoft.com.my

@ Copyright 2009-2023 Goldsoft Sdn. Bhd. I Company Registration 199701012508 (428004-P). All Rights Reserved.

Retail Inventory ERP System / Trading Distribution ERP System / Retail POS System / Consignment Inventory System / Warehouse System / e-Commerce

Image by Freepik