Malaysia e-Invoicing ERP and Middleware Solutions

Switching to

E-Invoicing with Goldsoft Solution

Accredited Peppol Ready Service Provider (PRSP) and Service Provider (SP) for e-invoicing

GET STARTED

We're thrilled to announce that Goldsoft is now an Accredited Peppol Ready Service Provider (PRSP) and Service Provider (SP) for e-invoicing!

This milestone reinforces our commitment to helping businesses ensure regulatory compliance and streamline their invoicing processes.

What is e-Invoicing?

e-Invoicing is the electronic exchange of invoices between businesses and government entities. The Malaysia Inland Revenue Board of Malaysia (LHDN) is mandating e-Invoicing for all commercial taxpayers to streamline processes and enhance efficiency.

Why Choose Goldsoft for Malaysia e-Invoicing?

With 29 years of experience in ERP and accounting solutions for Malaysia's retail and trading distribution, and successful GST and SST compliance, Goldsoft is poised to guide businesses through e-Invoicing.

Trusted by Leading Businesses Across Malaysia

Join the growing network of Malaysian companies that have chosen Goldsoft’s certified e-Invoice solution for LHDN compliance and seamless integration.

What Are the Benefits of Adopting e-Invoicing?

Streamline Financial Processes

Provides businesses of all sizes and sectors in Malaysia with an opportunity to streamline their financial processes, reduce manual works and improve transparency.

Improve Cashflow

Accelerate payments by significantly reducing billing and calculation errors with e-invoicing, thereby minimizing disputes and irregularities.

Compliance and Accuracy

The implementation of a compliant interoperable e-Invoicing framework will help you stay compliant with Malaysia LHDN's regulations and industry standards.

Malaysia e-Invoice Implementation Date

Taxpayers with an annual turnover or revenue of less than RM 1 million are exempted from implementing e-invoice.

NOTE: Taxpayers are eligible for six (6)-months interim grace period from the date of mandatory implementation of each implementation phase. For group 4, the interim grace period will be extended until 31 December 2026.

Types of e-Invoice To Be Issued in Malaysia

The Malaysia e-invoice system includes several types of e-invoices, such as invoices, credit notes, debit notes, refund e-invoices, and self-billed e-invoices. Each type serves a specific purpose in electronically documenting transactions.

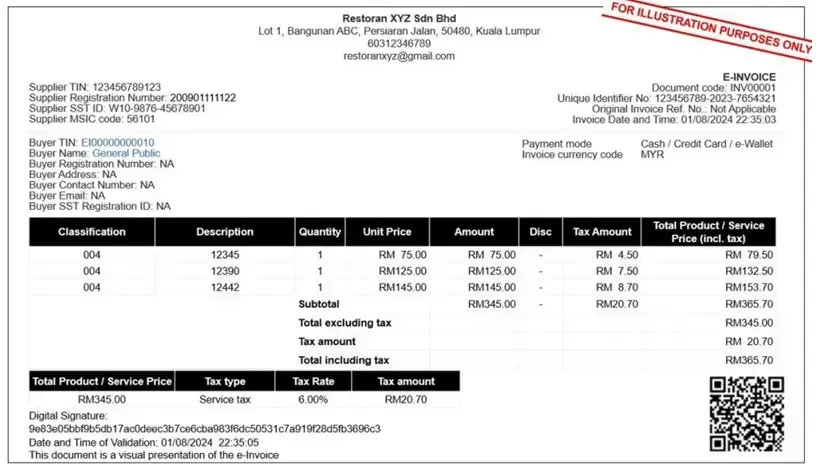

Standard e-Invoice

A detailed transaction record between a supplier and buyer.

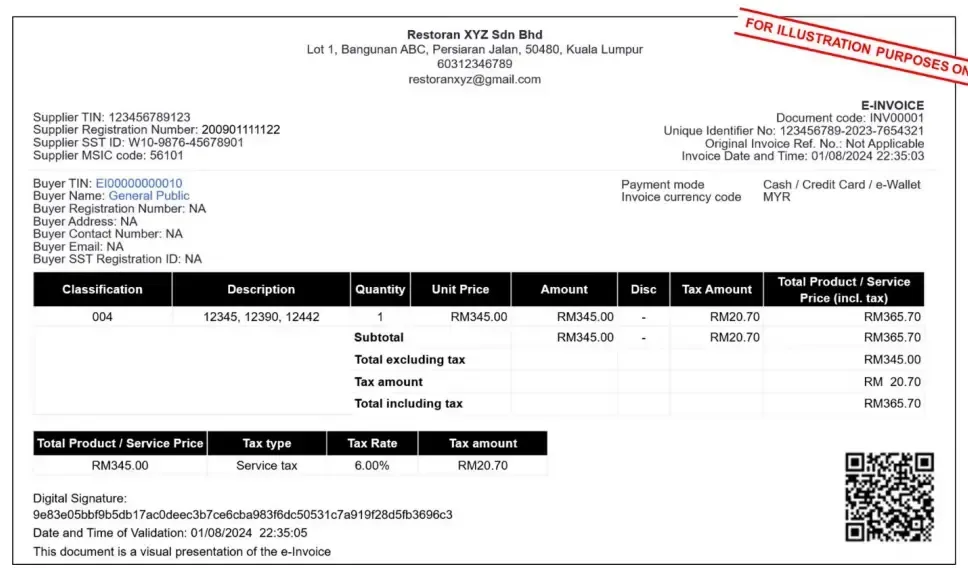

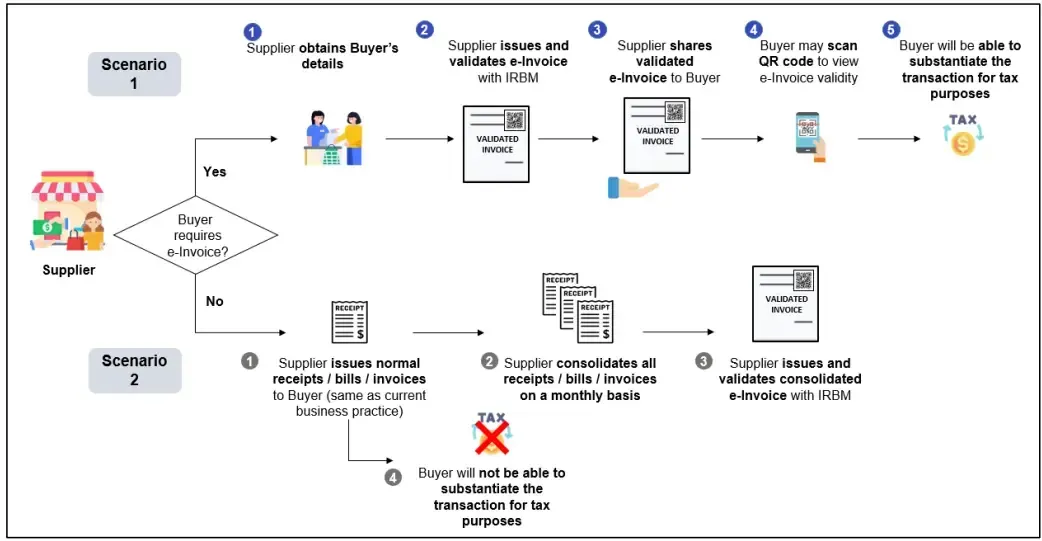

Consolidated e-Invoice

The supplier consolidates all receipts (where e-Invoices are not required by buyers) within 7 calendar days after month end.

Credit Note

To adjust the amount owed due to returns, discounts, incorrect amounts delivered, or other discrepancies.

Debit Note

To adjust the originally agreed-upon total, for example, for additional customer services or incurred extra costs.

Overview of The e-Invoicing Process in Malaysia

There are two scenarios: where the customer requires an e-invoice and where the customer does not require an e-invoice.

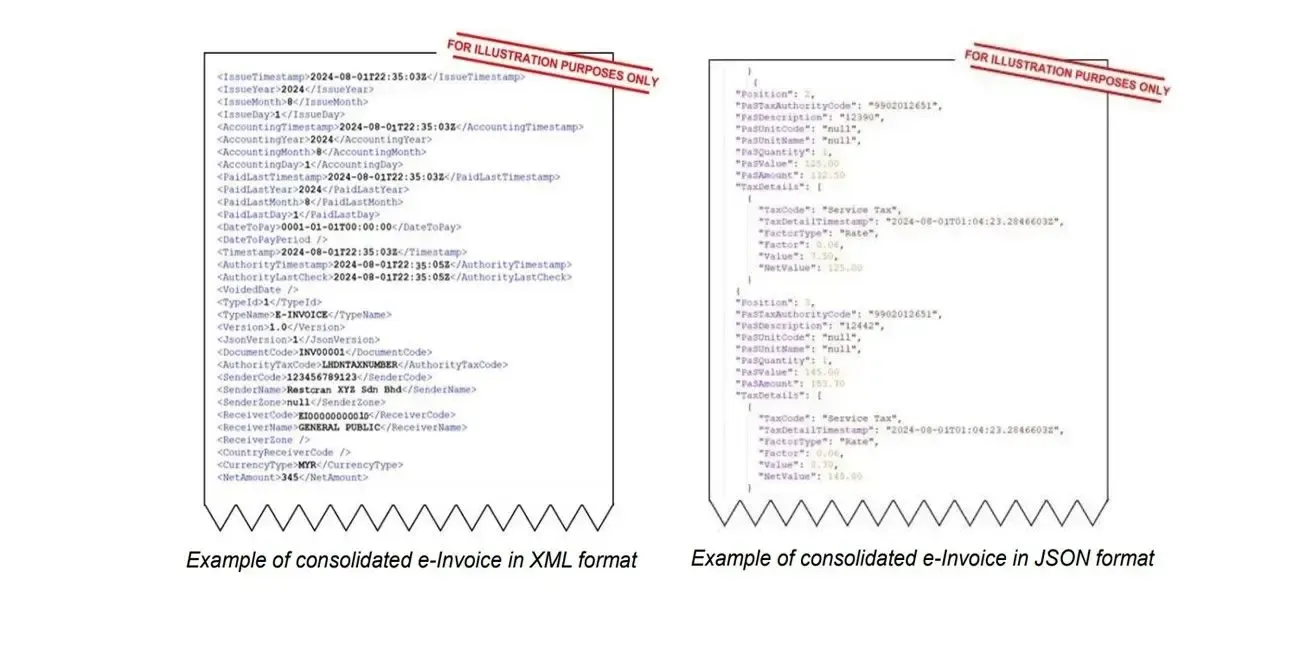

Example of Validated e-Invoices

The following is an example of an Malaysia's LHDN validated e-invoice in the specified XML or JSON format. The required data fields include 36 mandatory and 19 optional fields, totaling 55 data fields, in compliance with the e-invoice guideline version 2.3, published on April 6, 2024.

How to Prepare for e-Invoice Implementation?

e-Invoicing will become mandatory for all Malaysia's taxpayers regardless of sales threshold from January 2027. We would encourage taxpayers to conduct meetings with your key stakeholders and team members before making a decision on a solution that best fits your purpose.

1. Understanding Regulatory Requirements:

Familiarize yourself with the

e-invoicing regulations and standards set forth by

LHDN Malaysia, ensuring compliance with all legal obligations.

2. Assessment of Current Systems:

Evaluate your existing invoicing systems and processes to identify areas that may need adjustment or upgrade to accommodate e-invoicing requirements. Example able to generate and issue e-invoices via API in JSON/ XML formats.

3. Selection of e-Invoicing Solution:

Select an e-invoicing solution aligning with your needs, considering integration capabilities, scalability, and compliance features. Assess current system compatibility and potential enhancements or integration with other middleware/software.

4. Vendor Collaboration and Support

Collaborate closely with your chosen e-invoicing vendor to leverage their expertise and support throughout the implementation process, ensuring successful deployment and ongoing maintenance.

Goldsoft e-Invoicing Solutions

Goldsoft e-Invoice Ready

ERP Solution

(Direct Integration of Goldsoft ERP with MyInvois System)

- Ideal for retail and trading distribution companies.

- e-Invoices are generated in Goldsoft's ERP system and sent directly to the LHDN MyInvois System without human intervention.

- Clients able to track and monitor e-invoice submissions, validation, and statuses in real-time via e-invoice dashboard.

- Seamlessly access financial data from various devices anytime, anywhere.

Goldsoft e-Invoice

Middleware Solution

(Integration of Client's system with MyInvois System)

- Ideal for companies across all industries looking to streamline e-invoicing processes.

- Enable your company to send e-invoices, using your existing ERP/accounting software.

- Goldsoft as a service provider to convert documents (SFTP/ API/ Batch File Upload) to standard specifications and send it to LHDN.

- Clients able to track and monitor e-invoice submissions, validation, and statuses in real-time via e-invoice dashboard.

- Seamlessly access financial data from various devices anytime, anywhere.

Universal e-Invoicing Solution for All Industries

Our Goldsoft e-Invoice Solution enables businesses in any field, from retail and trading to manufacturing, education, and more, to stay fully compliant with LHDN e-invoicing standards and regulations.

Retail

Trading & Distribution

Optical

Education

Manufacturing

Entertainment

Restaurants

Professional Services

Telecommunications

Logistics

Healthcare

Construction

Tourism

Real Estate

Automotive

Others

Why Choose Goldsoft for your e-Invoicing Needs?

Discover the benefits of Malaysia e-invoicing with Goldsoft solutions

Integration to LHDN

Experience effortless integration between Goldsoft's e-invoicing solution and the Malaysia's LHDN MyInvois System, ensuring smooth data transmission and compliance with LHDN regulations.

e-Invoice Efficiency

Enjoy streamlined invoice generation, data validation, and real-time tracking of e-invoice statuses, resulting in increased operational efficiency and reduced manual errors.

Reliable Support and Assistance

Benefit from dedicated customer support and assistance from Goldsoft, ensuring a smooth implementation process and ongoing assistance for any inquiries or issues that may arise.

Data Security and Integrity

Goldsoft e-Invoicing prioritizes the security of your financial data, employing industry-standard encryption, secure cloud infrastructure, and stringent access controls to safeguard sensitive information.

Get In Touch With Us

We'll explore your system requirements and discuss the specifics needed for you to achieve e-invoice compliance.

GET STARTED

e-Invoice Malaysia FAQ- General Questions

e-Invoice Malaysia FAQ- Seller and Buyer Questions

LHDN e-Invoice Frequently Asked Questions: https://www.hasil.gov.my/en/e-invoice/frequently-asked-questions/