Consolidated e-Invoice: What You Need to Know

An alternative way of e-invoicing where buyer don’t require e-invoice.

Update as of 12 September 2025:

The Inland Revenue Board of Malaysia (IRBM) has introduced additional requirements regarding

consolidated e-invoices.

Effective 1 January 2026:

- Electricity service providers are not allowed to issue consolidated e-invoices for the distribution, supply, or sale of electricity.

- Telecommunication businesses in relation to postpaid plan and internet subscription, and sale of electronic devices are not allowed to issue consolidated e-invoices.

Companies in these sectors should review their invoicing processes to ensure compliance before the effective date.

Recently, the implementation of e-invoicing is a significant step towards modernizing the tax system and enhancing compliance in Malaysia. At the time of publication, phase 1 of e-invoicing is currently ongoing with many of the Group 1 companies (annual sales turnover > RM100 million) starting to utilize the e-invoicing system. In contrast, Group 2 and Group 3 will soon join the e-invoicing in the following year. Before we dive into this topic, it is highly recommended to read our previous blog posts below to understand the fundamental of e-invoicing.

What is Consolidated e-Invoice?

Normally, suppliers will issue individual e-invoice after each transaction and shares it to IRBM for validation. But what if the buyer doesn’t require an e-invoice?

That is where suppliers should create a consolidated e-invoice when the buyer doesn't need an e-invoice following a transaction. In such cases, the supplier provides standard receipts, bills, or invoices to the buyer. Subsequently, the supplier combines all these documents into a single consolidated e-invoice, which must be submitted to the Inland Revenue Board of Malaysia (IRBM) for validation within 7 calendar days after the end of the month.

However, with the recent announcement of the 6-month grace period, all activities and businesses are allowed to only issue consolidated e-invoices without issuing an e-invoice for each transaction from the date of mandatory implementation.

Related article:

How to issue consolidated e-invoice?

The process of issuing consolidated e-invoice is similar to the standard e-invoice procedure with the key difference being that the validated e-Invoice serves as the supplier's proof of income and does not need to be shared with the buyer.

Step 1: The supplier should first confirm with the buyers whether an e-invoice is necessary.

Step 2: If the buyers indicate that an e-invoice is not needed, the supplier should continue providing receipts to them.

Step 3: Within 7 calendar days after the month's end, the supplier should gather all the receipts issued during the previous month and create a consolidated e-Invoice to document the supplier's income.

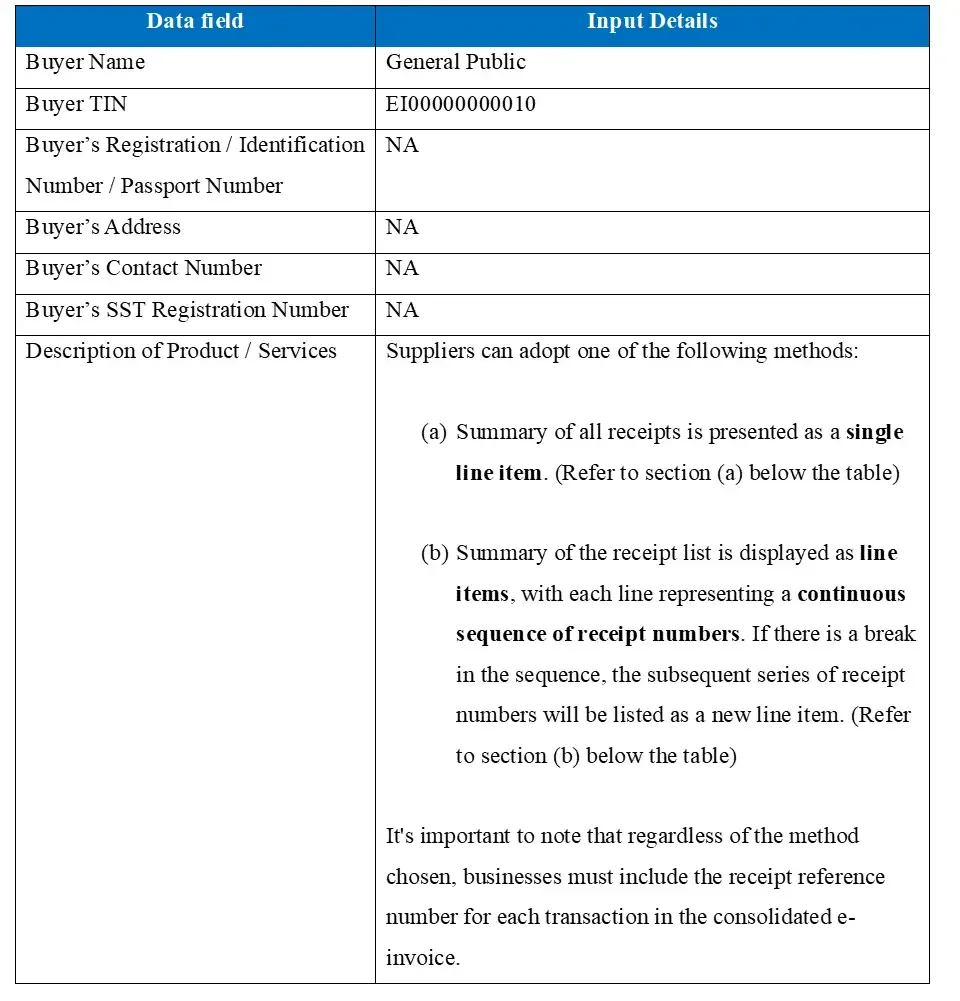

Step 4: The supplier must issue the consolidated e-invoice according to the Buyer Details in Consolidated e-Invoice in the table below. After that, IRBM will notify the supplier once the e-invoice has been validated.

Buyer Details in Consolidated e-Invoice

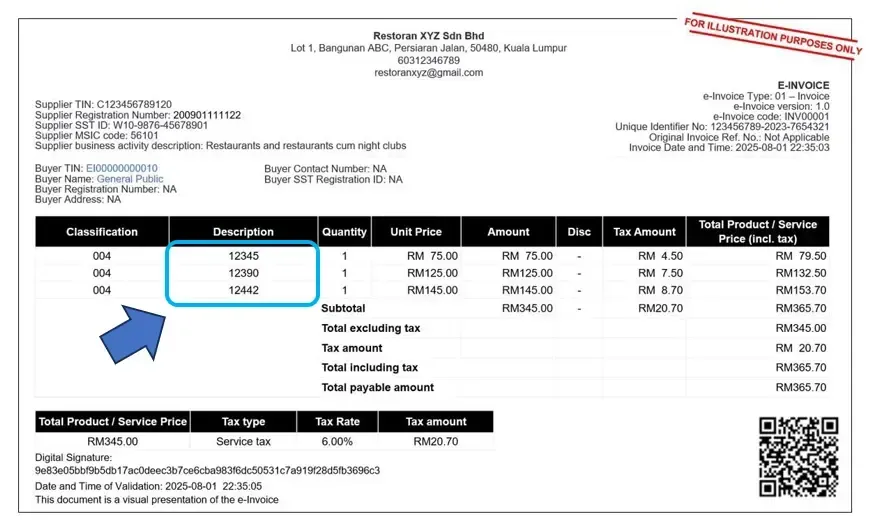

(a) Summary of all receipts is presented as a single line item

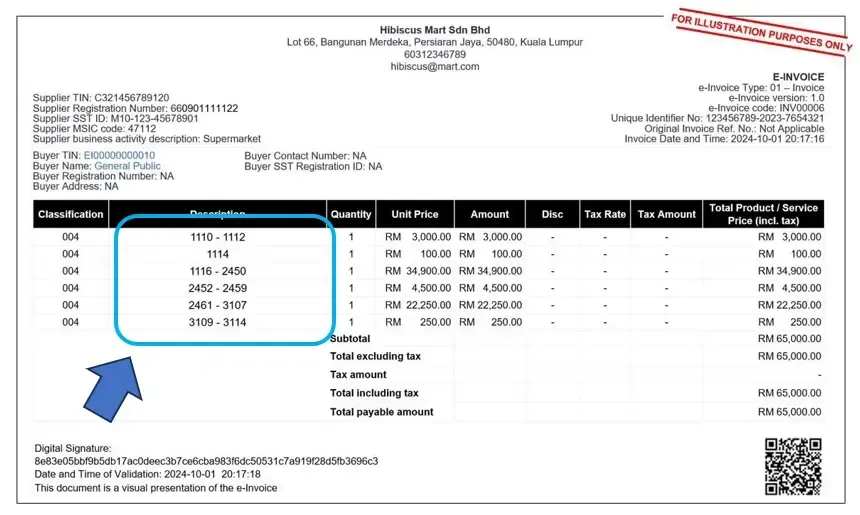

(b) Summary of the receipt list is displayed as line items, with each line representing a continuous sequence of receipt numbers. If there is a break in the sequence, the subsequent series of receipt numbers will be listed as a new line item.

What parties are not allowed to issue consolidated e-invoice?

Currently these activities or transactions of industries where consolidated e-invoice are not allowed to issued and required to issue e-invoice for every transaction.

- (NEW) All industries: Any single transaction with a value exceeding RM10,000, which must be issued as an individual e-invoice even if the buyer does not require one. (Effective starting 1 January 2026)

- (NEW) Electricity: Distribution, supply or sale of electricity. (Effective starting 1 January 2026)

- (NEW) Telecommunication: Telecommunication services in relation to postpaid plan and internet subscription, and sale of electronic devices. (Effective starting 1 January 2026)

- Automotive Industry: The sale of any type of motor vehicle that is powered by a mechanism within itself and designed or modified for use on roads, including trailers.

- Aviation: The sale of airline tickets and private charter services.

- Luxury Goods and Jewelry: Further details are still being clarified.

- Construction: Contractors involved in construction projects as outlined in the Income Tax (Construction Contracts) Regulations 2007.

- Licensed Betting and Gaming: Payments to winners from all betting and gaming activities, with the exception that payouts in casinos and from gaming machines are currently exempt from e-invoice requirements until further notice.

- Payments to Agents, Dealers, or Distributors: Any payments made to individuals authorized by a company to serve as its agent, dealer, or distributor, who receives compensation (in cash or other forms) from the company for sales, transactions, or schemes conducted in their capacity as an agent, dealer, or distributor.

Conclusion

The introduction of the e-invoice system in Malaysia represents a significant advancement in the country’s digital transformation efforts. The implementation of consolidated e-invoice can reduce administrative burdens while simplifying the e-invoicing process. During the 6-month relaxation period, businesses may issue only consolidated e-invoices if they do not issue individual e-Invoices per transaction, as long as they comply with IRBM's relaxation guidelines.

For more detailed information, businesses are encouraged to refer to the IRBM's specific guidelines and FAQs on e-invoice implementation.

Sources:

https://www.hasil.gov.my/media/uwwehxwq/irbm-e-invoice-specific-guideline.pdf

https://www.hasil.gov.my/media/0xqitc2t/lhdnm-e-invoice-general-faqs.pdf

https://www.hasil.gov.my/media/fzagbaj2/irbm-e-invoice-guideline.pdf

How Goldsoft can help you:

-

Option 1: Malaysia e-Invoice Ready ERP SolutionList Item 1

This solution direct integration of Goldsoft ERP with MyInvois System:

1. e-Invoices are generated in Goldsoft's ERP system and sent directly to the LHDN MyInvois System for validation. Once validated, embedded with a QR code containing the validation link, send to the client company.

2. This integration streamlines invoicing, reduces manual effort, minimizes errors, and ensures smoother transactions with the same vendor.

3. Client company is able to track and monitor e-invoice submissions, validation, and statuses in real-time.

4. Ideal for Malaysian retail and trading distribution companies needing e-invoice compliance system.

-

Option 2: Malaysia e-Invoice Middleware Solution

This solution uses Goldsoft as middleware to connect client's existing software to the e-Invoicing network:

1. Clients can continue using their existing ERP/accounting system.

2. Enable client company to send e-invoices, using your existing ERP/accounting software, Goldsoft as a service provider to convert documents to standard specifications (XML/JSON) and send it to LHDN for validation. Once validated, embedded with a QR code containing the validation link, send to client company.

3. Client company is able to track and monitor e-invoice submissions, validations, and statuses in real-time.

For more information about Goldsoft e-invoice Ready ERP/ e-invoice middleware, please do not hesitate to contact Goldsoft's sales team at 03-2732 8833 or fill up the form below for enquiry.

Contact Us

Share

Recent Articles