Expansion of Sales & Service Tax (SST) 2025 Explained

What You Need to Know About the Latest SST Changes in 2025

Starting 1 July 2025, Malaysia has expanded the scope of its Sales and Service Tax (SST). This move is part of the government’s efforts to strengthen fiscal sustainability under the MADANI Economy agenda. For businesses, this expansion brings new compliance requirements, updated tax rates, and broader coverage of industries. Understanding these changes is crucial to avoid unexpected costs and to remain compliant.

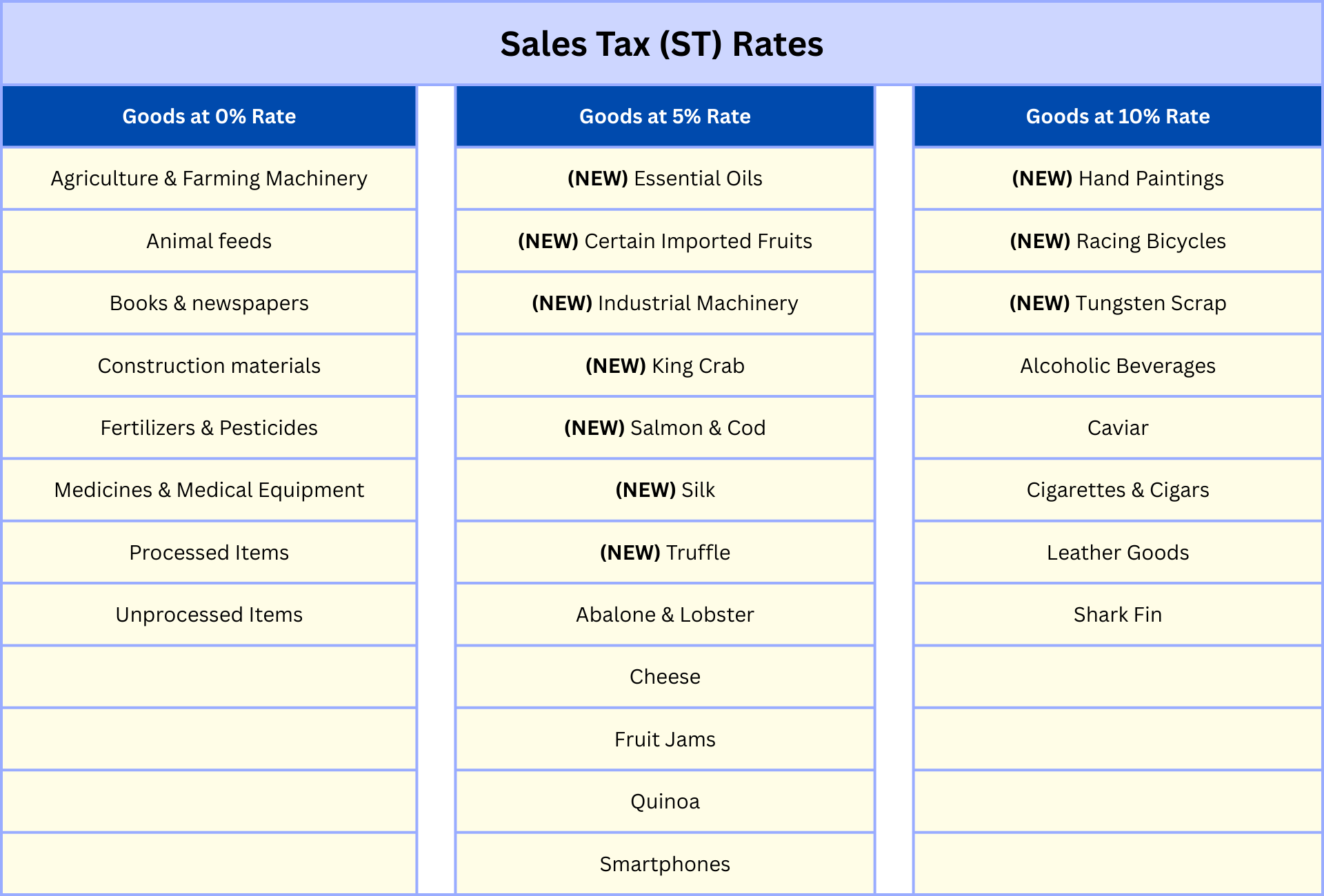

Key Changes in Sales Tax

The biggest impact for the retail sector comes from the expansion of Sales Tax.

- Newly taxed items now include certain non-essential and luxury products such as certain imported fruits, premium seafood (e.g., salmon, king crab), essential oils, silk, artworks, and racing bicycles. These items are subject to a 5–10% sales tax.

- Essential goods continue to be

zero-rated. Products like

rice, books, medicines, and basic building materials are not affected, ensuring no additional burden on daily necessities.

Key Changes in Service Tax

The service tax has seen the most significant expansion. A wide range of services that were previously not taxed are now included. Depending on the category, the tax is applied at 6% or 8%.

Sectors affected include:

- Leasing & Rental

- 8%, with exemptions for residential properties, financial leasing, and B2B transactions for subletting tangible assets.

- Registration is required when the total value of taxable services reaches RM1,000,000 per year.

- Construction

- 6%, exemptions for federal or state government services and non-reviewable contracts signed before 9 June 2025.

- Registration is required when the total value of taxable services reaches RM1,500,000 per year.

- Financial Services

- 8%, applied to fee-based activities, banking, and insurance services

- Registration is required when the total value of taxable services reaches RM1,000,000 per year.

- Private Healthcare

- 6%, applies primarily to non-Malaysians

- Registration is required when the total value of taxable services reaches RM1,500,000 per year.

- Private Education

- 6%, if charges exceed RM60,000 per student per academic year.

- Exemptions apply to special education schools, language centers and services for Malaysian citizens and OKU cardholders.

Imported taxable services are still included, with Malaysian recipients responsible for self-accounting.

Transition and Compliance

To help businesses adapt, the government has introduced a grace period until 31 December 2025. During this time, any penalties such as late registration or minor filing errors will not apply if businesses show reasonable efforts towards compliance.

For businesses, key steps include:

- Reviewing product and service categories to identify which goods or services now fall under the new tax scope.

- Updating pricing and invoicing processes to ensure correct tax handling.

- Monitoring supplier invoices to confirm accuracy.

Conclusion

The expansion of SST in Malaysia marks a significant shift in the country’s tax landscape. While essential goods remain protected, many industries will now face new compliance and pricing challenges. Businesses should start by reviewing their services, contracts, and invoicing processes to ensure alignment with the latest requirements.

Staying compliant may feel overwhelming, but the right ERP system can make the process much smoother. Goldsoft’s ERP solutions help businesses keep their invoicing, reporting, and product categorization accurate, reducing the risks of errors when adapting to the new SST framework.

Let's Talk:

Share

Recent Articles